Starting the game strong on offense, or vice versa, can quickly change the complexion of how games transpire. Today I wanted to look at and provide data context for how offensive coordinator Arthur Smith’s teams have fared in his previous coaching stops (since 2019). The same data for the Pittsburgh Steelers will be examined, a team who has struggled to open games in recent memory. The goal is to see what we might expect for the 2024 season.

To start, here are opening drive average number of plays and yards per game:

Out of the teams we’re focused on, Smith’s 2022 season as head coach of the Falcons was the only one above-average in both data points in the five-year span (out of 160 qualifiers).

Their 7.9 average number of plays tied for 12th-best in the timeframe, and third in the 2022 season. More subtly above the mean was their average yards at 38.2, tying for 63rd overall, and 14th that year.

Many consider 2022 Smith’s best season in his time with the Falcons, his opening drives aligning with that notion.

The stronger season in Tennessee, where Smith was the OC, was his final one in 2020. They fared particularly well in average yards with 42.5, tying for 29th in the span, and sixth that season. This came on a below-average number of plays (5.9), which was unfortunately true for the majority of the teams in our sights.

Smith’s other above-average mark was the following year (2021), his first as head coach of Atlanta, with 7.1 average number of plays that tied for 41st overall, and ninth that year.

The rest of Smith’s units were below-average in both data points. That included his most recent 2023 season in Atlanta and surprisingly in his first year as OC with the 2019 Titans. So, three of the five squads he was commanded of had an above-average result.

Pittsburgh had just one. That was the 2022 season, where the Steelers tied for their most plays on opening drives with 7.7. That tied for 17th overall, and fifth-best that year which was better than I anticipated.

Otherwise, Pittsburgh has been a below average-team in average number of plays and yards since 2019. They were particularly poor that season, bottoming the results with an injury-riddled QB room. Bottom-five of each stat overall, and the absolute worst 11.4 average yards, roughly five yards less than any other team in the span.

This also included last season, when Pittsburgh averaged 5.2 plays (31st in 2023) and 27.4 yards (26th). A clear regression for QB Kenny Pickett in his second season, aligning with Pittsburgh moving on.

For comparison, here’s how the new Steelers QB’s fared with their former teams in 2023:

Russell Wilson (Broncos 2023): 6.5 plays (18th), 36.2 yards (13th).

Justin Fields (Bears 2023): 6.4 plays (T-19th), 39.2 yards (10th).

The new QB room has had more success than Pittsburgh, along with Smith in the time frame (including last season), creating optimism for 2024.

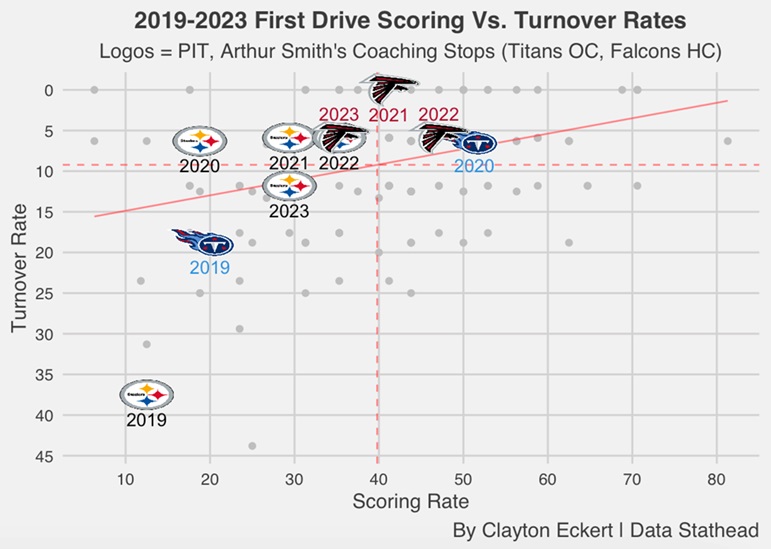

Next, let’s look at the outcomes of these drives more with scoring and turnover rates:

Once again, we see Smith’s units fared better overall in the span. Three of his teams topped the focused squads in scoring rate results, particularly 2020 in Tennessee and 2022 with the Falcons.

That Titans team scored on 50-percent of their first drives, eight of their 16 games in 2020. That included seven touchdowns and one field goal, contributing to an 11-5 record, the best of Smith’s time there.

They were also above-average in turnover rate (6.3-percent), with one interception. Seven of the ten teams in our sights were above average in this regard, four of Smith’s former units (2020 Titans, each Falcons team), and three Steelers squads (2020-2022).

The 2022 Falcons were also above the mean in both with a 47.1 scoring percentage (five touchdowns, three field goals). Just one turnover (interception) as well for a 5.9 turnover rate that tied for eighth. So solid marks as well.

Atlanta had an impressive zero turnovers on opening drives in 2021, paring that with a 41.2 scoring rate, emphasizing more specifics on Smith’s stronger results that will hopefully carry over to Pittsburgh.

Last season, Smith’s Falcons were below average with a 35.3 scoring rate that tied for 18th in 2023, while remaining above average in turnover rate (5.9) that tied for tenth (one interception). The scoring result makes some sense with a regression in quarterback play but notable nonetheless as we anticipate what the 2024 Steelers will look like.

Quarterback changes galore are obviously a huge component in Pittsburgh too. Here’s how the new room fared last season:

Russell Wilson (Broncos 2023): 52.9 scoring rate (T-fifth), 11.8 turnover rate (T-20th).

Justin Fields (Bears 2023): 41.2 scoring rate (T-11th), 0.0 turnover rate (T-first).

Wilson provided a lot of contributions to opening drive scores, which is exactly what you want to hear from the expected starter heading into 2024. Six touchdowns and three field goals, to be exact. Fields and Chicago last season did a nice job as well, but even more impressive was their zero turnovers.

For Pittsburgh, we see the aforementioned turnover rates largely strong. But, as you might expect their scoring rates were below-average, in each season of the five-year span. This highlights another needed change on offense for the Steelers, a reoccurring theme that hopefully Smith and company can remedy.

The best balance of both data points was in 2022, namely an above-average 5.9 turnover rate (T-7th best that year). Pittsburgh’s 35.3 scoring percentage tied for 19th that season, their top mark since 2019. Room for optimism is a positive trend the last three years for Pittsburgh, so lots of the data points to a better 2024 on opening drives.

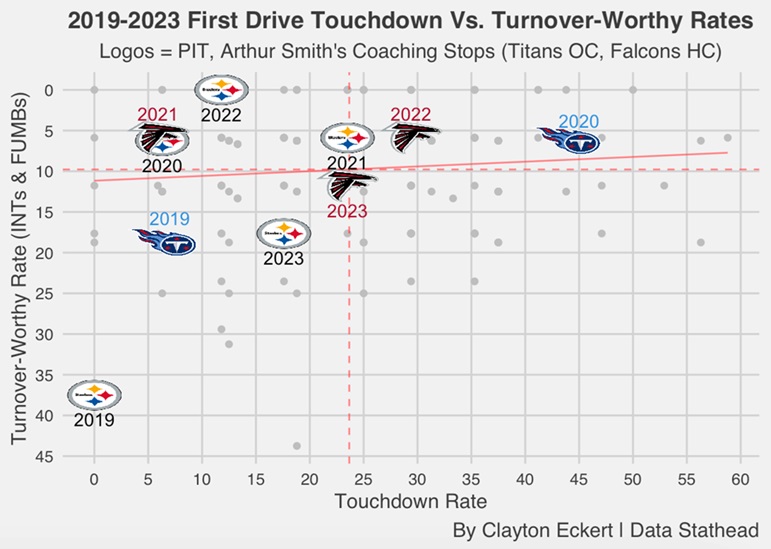

Diving deeper, here are rates that zoom in on offensive production (removing field goals), touchdown and offensive turnover rates (interceptions and fumbles):

Here we get an even clearer picture of what offenses have done in recent history. The 2020 Titans and 2022 Falcons remain the only focused teams above the mean in each stat. 43.8-percent of opening drives for that Tennessee unit, which tied for third-best in 2020 and ninth out of all qualifying teams. A return to Smith’s results in his final season at OC would feel magical compared to Pittsburgh’s recent offerings.

That group was comfortably above all other focused teams, with Atlanta in 2022 the second-best focused team at 29.4-percent, tying for eighth that season but clearly lower than the previously mentioned Titans squad.

Pittsburgh still landed above=average in turnover-worthy rates from 2020-2021as they did in the prior view, along with being largely below-average in touchdown rates. As stated earlier, seven focused teams had above average turnover rates. Looking at turnover-worthy rates, last season’s Falcons dropped slightly below the league mean since 2019 (11.8-percent, T-17th), retaining a fumble.

So, we saw progression in Smith’s two years as OC in Tennessee, along with the following two years in Atlanta, but a regression last season in both stats. This makes sense but is not limited to their QB struggles.

Not to the extent Pittsburgh had: 17.6 touchdown rate (T-19th) and a 17.6 turnover-worthy rate (T-27th). For how well the Steelers generally take care of the football, opening drives have been an issue (two interceptions, one fumble) that will hopefully trend positively in 2024.

2019 was not ideal for focused teams, particularly the Steelers as expected: 0.0 touchdown rate – wow – and a whopping 37.5 turnover-worthy rate that was second worst among qualifiers (four interceptions, two fumbles). Glad those painful memories are further behind us.

It was also Smith’s worst results, below-average in both stats. It’s important to note 2019 was his first season coaching, but still on the resume with a talented unit: 6.3 touchdown rate and 18.8 turnover-worthy rate, tying for 27th and 25th. Four seasons of stronger results since brings optimism for 2024, encouragingly.

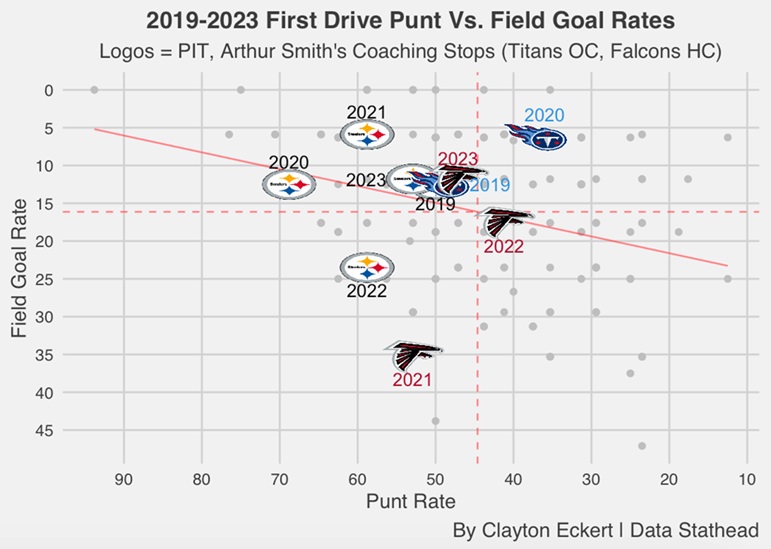

On the other side of the coin, let’s briefly examine the opening drives that sputtered on offense, and ended in kicks (field goals or punts). I sorted lower numbers as good, since offensive touchdowns are the ultimate goal:

If an offense does fail on an opening drive, a field goal or a punt is obviously a big difference. We can see punt rate is another aspect of play that favored Smith’s teams, with Pittsburgh below the league mean in all five seasons.

The 2020 Titans and 2022 Falcons were above-average in limiting punts on opening drives, added context to prior strong marks. Seven focused teams had limited field goal rates, with the exceptions being the 2021-22 Falcons and 2022 Steelers.

Don’t get me wrong, a strong kicker such as Steelers Chris Boswell is invaluable. But we can see those teams had to “settle” for three points on opening drives too often.

Last season, both Pittsburgh and Atlanta had limited field goal rates, but more notably had to punt around half of their opportunities. The Falcons were a bit better, with a 47.1 punt rate (T-15th), compared to 52.9 for the Steelers (T-22nd in 2023).

To wrap up, here is a table of all the stat ranks (by season) compiled for the study:

The table paints a great encapsulating picture of the strengths and weaknesses of each team. Smith encouragingly had better results than Pittsburgh in the timeframe overall, which gives optimism for 2024. A regression for Smith last season though, along with Pittsburgh, will hopefully put these issues high on the priority list to remedy this season.